All Housing Is Affordable Housing

As a mortgage lender (and investor) in Lane County, I am on the front lines daily in the field of housing affordability. While it is a multifaceted issue, there are some basic economics at play that seem to get lost in the conversation. I put together some thoughts on this topic in order to help give everyone a good base understanding of the problem and (hopefully) some commonsense ideas on how to approach solutions. Here is the first in a series.

Every person needs a place to live, and each person (or family) will choose the best available option given their budget. Factors that go into these decisions are many, but location, size, and amenities are the major determinants of the cost of each home. Since those are wrapped up into price, we'll just use price as a stand-in for various qualitative factors.

The Current Market

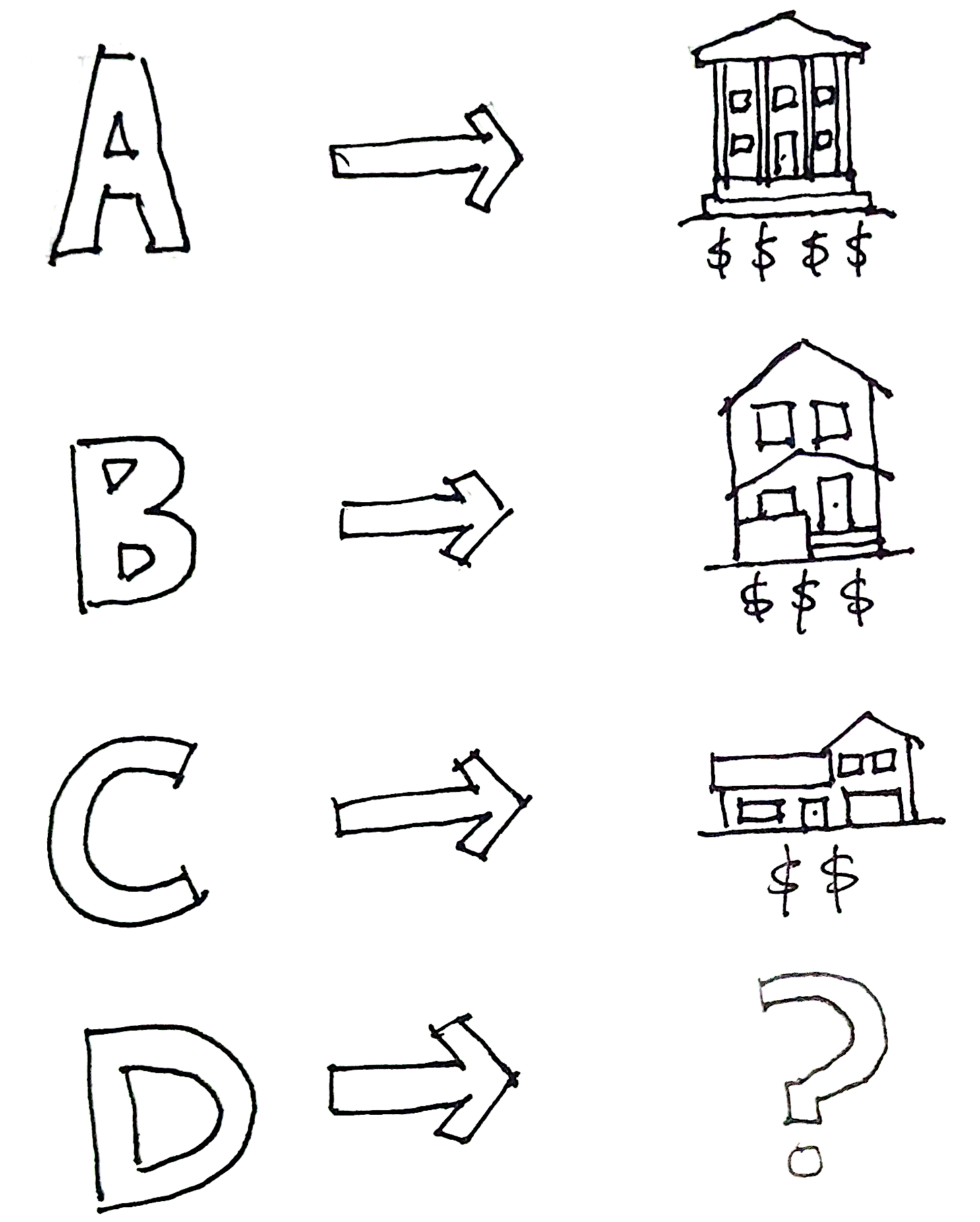

For an example, let's present four households, each in the market for a home (rent or buy, the economics are the same):

- A - a wealthy household

- B - upper-middle class

- C - middle class

- D - working class

In a balanced market, there would be four homes of different qualities at price points that would allow each of the four households to find a home that fits them.

In a constrained market where demand is greater than supply (either through under-building, in-migration, etc..) we'll say there are now only three homes available for the four households.

Since A has the most purchasing power, they will outbid the others for the nicest property. B will then outbid C for the middle home and C will outbid D for the last property available. Household D is out of luck and either needs to rent instead of buy. If this is a rental scenario, they'll need government assistance to compete with C (aka Section 8) or move to a lower-cost area where they can compete for housing. Most people would agree that this describes (albeit simply) how their local housing market operates

Adding Housing

To solve our theoretical problem of finding shelter for household D, we need to add a unit to bring the market back into balance, but at what price point?

The simplest answer (in theory) is to build a home at the lowest price point so that D can afford it. Then all parties have an appropriate home and the market is in balance.

There are a myriad of reasons why this is difficult to achieve in practice. In order to better understand those factors, it's helpful to talk about what makes housing cheaper

What Makes Housing Affordable?

The easiest way to think of what makes a cheaper home is to invert all of the qualities that make a home expensive:

- less desirable location

- smaller

- fewer amenities

- older

A less desirable location can take many forms. Being further away from jobs/schools/shopping or being located next to the highway/train tracks/industrial areas, for example. Smaller can mean either smaller units, smaller lots, or both. Less space for your family, less privacy with neighbors close by. Fewer amenities is self-explanatory.

Unless a home is diligently maintained and updated at the owner's expense, houses deteriorate over time. While older houses are sometimes built 'better' than newer homes and can have period charm and character, they don't have the amenities of newer homes to fit our modern lifestyles. Maintenance costs also grow exponentially as problems compound on each other. Lower income households don't often have reserves or available cash to make the repairs necessary to hold steady, leading to home and neighborhood decline.

The **ONLY** way to make housing that doesn't have these factors more affordable is to subsidize the cost through government or non-profit programs.

How To Provide Affordable Housing

In order for the market (aka not government) to provide another home that is affordable to household D is to build a new unit.

By definition, you can't build an old home. And new construction, regardless of price point, is expensive. Modern building codes, high material costs, and higher labor costs contribute to a base level of cost to build new. If the price or rent that household D can afford to pay won't cover the cost to build or operate the unit, then the market can't provide housing that is directly affordable to them.

A less-desirable location will bring cheaper land prices, lowering the overall cost of newer housing (though building new is still expensive). But building new housing on the outskirts of town often brings longer commute times (and additional transportation costs) and less access to amenities, lowering quality of life. Further, this type of development can lead to direct and indirect environmental degradation and soaring infrastructure costs that can fiscally endanger local governments (a topic for another time). Zoning and NIMBYism have also tag-teamed over the last few decades to make it almost impossible to build 'affordable' housing in more-desirable locations, closer to amenities and jobs.

Building smaller with fewer amenities is the most surefire way to lower the cost of new housing, but is often not enough to make a market-built unit affordable to household D. The general public and affordable housing advocates often raise hay when a new luxury housing project is proposed or opened, complaining that we don't need high-priced houses, we need homes that are affordable to the masses. This ire is misdirected.

Market builders are only able to cater to households A, B, and C with a reasonable expectation of getting paid for the risk of their investment, **and that's okay**.

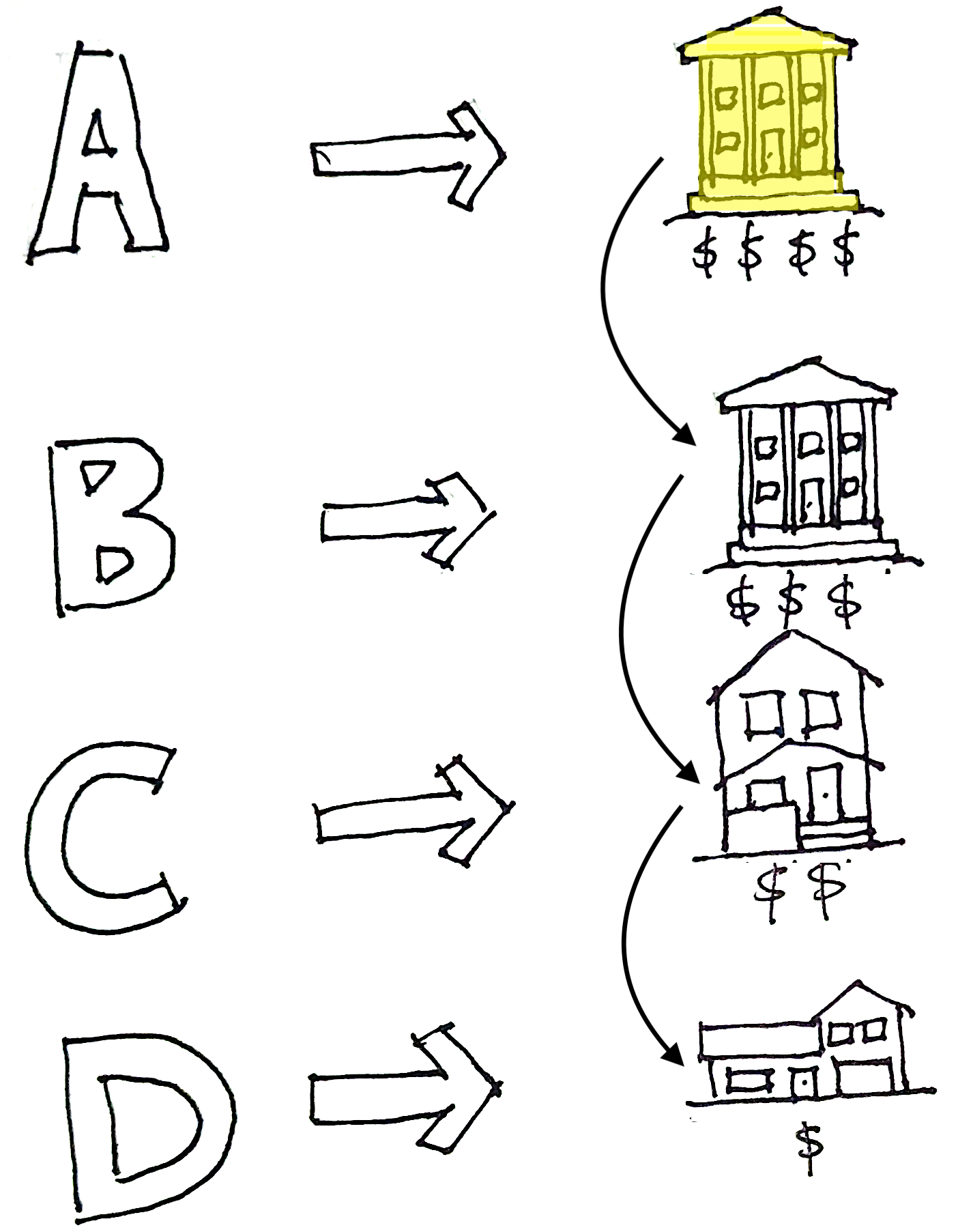

Why? Let's look at our hypothetical scenario again.

If we add a luxury home to our market, household A will now claim that home. This lowers the demand for the nicer house that A would have taken, so the price drops to the point that it becomes affordable to household B. The same effect occurs with the home that B just abandoned, so now C can afford a better place, opening up the cheapest unit for household D.

The same phenomenon occurs if we provide a mid-priced unit into our scenario. Households A & B stay put. Household C takes the new unit and vacates the cheapest unit again for household D.

Each unit added to the market, regardless of price point, will make the existing housing stock more affordable further down the economic chain. One more time for the people in the back:

👏 All 👏 Housing 👏 is 👏 Affordable 👏 Housing 👏

All housing is affordable to someone; wealthy, middle-class, or working class. When it is difficult or impossible to build new housing that is, without assistance, affordable to lower-income families, we can build for higher price points and the secondary effect will benefit all. The important takeaway is to build more.

But what about government assistance? Don’t they have a role to play in this?And if we need to build more, what should we build? Stay tuned for the next parts in the series!