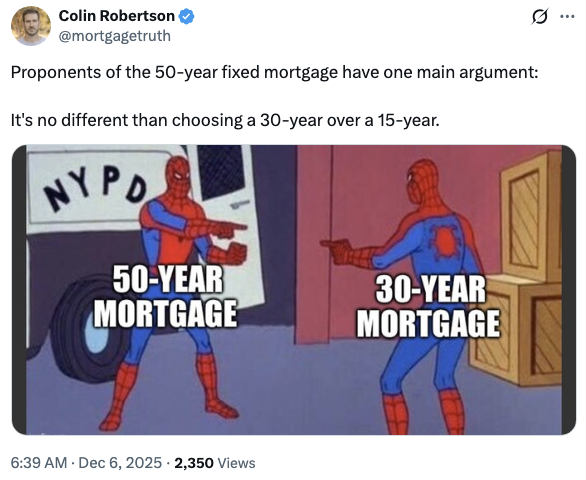

50 is the new 30

One of the hottest topics in housing finance circles recently has been this administration’s proposal of a 50-year fixed mortgage. The debate has broken contain into the normiesphere to the point where I’m fielding a lot of questions from home-seekers about the availability of, or the wisdom of, taking out such a long-term liability. Do I have thoughts? You betcha.

In the absence of specifics (since this is still just a proposed offering) we’ll have to make a few reasonable assumptions:

The rates on a 50-year loan will be higher than a 30-year loan, just as 30-year rates exceed 15-year rates because the refinance risk is higher on such a product.

Almost nobody will take a 50-year mortgage to term. Will you live in your house without refinancing for 50 years? Loans today are typically held between 7-10 years before a sale or refinance.

Ostensibly, these loans are being proposed as a way to increase housing affordability. Let’s look at the pros & cons for individuals considering these loans to make a purchase, as well as the larger question of whether these products will achieve the stated affordability goals.

Individual

The biggest benefit touted by the administration is that a 50-year loan will have lower monthly payments! That may be true! The interest rate will be higher than a 30-year to account for the increased refinance & default risk, but the payment be amortized over a much longer period. This can potentially make the difference in qualifying for a loan. That does have its drawbacks, however.

The flipside of the coin is that it will take much longer to build equity with a 50-year note. This can lead to scenarios where an owner is stuck with little-to-no-to-negative equity (after selling costs) for years, if appreciation stalls. Another downside may be the temptation to buy more house (big house = big happy) than one can really afford, which could accelerate the above effect.

Societal

Lower monthly payments will allow a buyer on the margin to be able to qualify for a mortgage. This new demand could help revive markets where supply has grown and prices have fallen in recent years (many areas of Florida and Texas, other parts of the South and Southwest).

The problem is that in the much of the country, housing supply has lagged far behind population growth (and will for the foreseeable future). Where new demand runs into limited supply, the result is higher prices and decreased affordability. Not the intended effect, yesno?

In summation, this is a demand solution to a supply problem. I think the effect of these loans, if they are rolled out, will be neutral-to-negative on housing affordability. The biggest winner will be the lenders who have another product to sell…